The difference between residential and commmercial development

In the past, we have focused on residential build-to-rent homes, but over the last two years we have dipped our feet into a few commercial projects. They are a big learning experience.

The concept of these commercial projects is the same as the residential homes: (1) Find the land; (2) fund the project; (3) build the structure; and (4) exit the deal. The main difference is that for commercial deals, each of these milestones requires a bit more sweat. Let me explain.

First, it is important to know that each project’s requirements are entirely subjective to the building department you are in. No two cities will be the same. Nevertheless, I will highlight some of the differences that we encountered along the way.

(1) Finding the land

Residential

For residential land we buy infill lots1 or larger residential lots to subdivide and build homes on. For infill lots the process is straightforward because the owners are usually not sophisticated and are happy to earn a profit on land that they inherited or bought at a bargain. First, we use mapping software (Acristo Engine) to scope out potential parcels. Then, we contact the property owner, negotiate the price, and close within thirty days. Easy peasy. For larger lots, the land is more likely to belong to a corporation or a sophisticated investor rather than a typical joe who has inherited land. This means we usually must go through their broker who is more adept at negotiating. The process can be longer and more complex, like commercial.

Commercial

Like the larger residential deals, commercial land is likely to take longer to scope out and acquire. Also, there may be roadblocks like multiple owners that all must agree on selling. Due diligence is also more of a pain on the commercial side. You want to make sure that the building department will approve your project before buying the land. A single-family home is more likely to be approved than a four-story apartment building with multiple restaurants surrounding it. This leads to many contingencies in commercial land contracts that can amount to a lengthy closing process.

(2) Funding the project

Residential

The type of funding you need will vary depending on the project. Let us focus on an infill single-family build. The way we fund it is by raising private funds to buy the land (which should not be more than $100k), taking out a construction fund for the project, and funding the rest of the deal from our own pocket. Again, quite simple because construction is very capital intensive and $100k is not that hard to raise in the grand scheme of things.

Commercial

Commercial projects tend to be more capital intensive. Let us compare a single-family home where the total project cost might be $300k and one of our twelve-unit apartment buildings which cost around $2.5M to build. The amount of money that we need to raise for the apartments is eight times that of what we need for the home. To raise more private money, you need to know people who can fund these types of deals, if you do not know more people, you need to network. Lenders will look at the deal more closely. They will often require proof of the funds required for the project in your bank account, which undoubtedly makes it more difficult to start.

(3) Building the structure

Residential

I have written extensively about this topic in the past. Building a single-family home is a rinse and repeat process because you are building the same models repeatedly. The permitting process is easy, especially after you have built homes. You will use the same materials, the same design team, and the same subcontractors if the project is in the same area.

Commercial

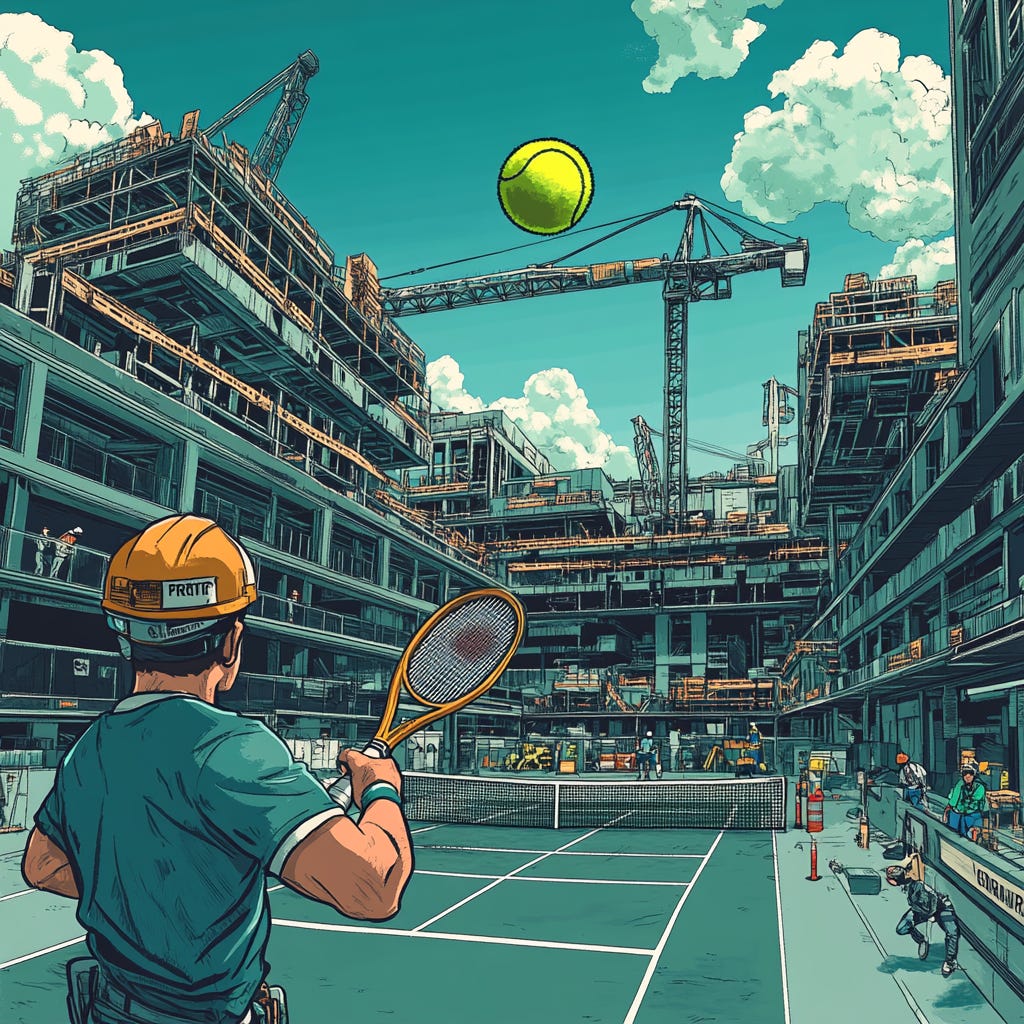

Think about commercial projects like a custom home. Every project is different. For starters, the permitting process can be a lengthy process that resembles a three-way tennis match between you, the building department, and your design team. You submit your documents to the building department, they ask for corrections, and the design team makes them. The process is present in residential construction but commercial takes many more rallies to win the match (permit approval). A quick glance at the residential versus the commercial building codes is enough for you to see how much more demanding commercial construction is. Commercial projects have more requirements in areas like parking, drainage, fire safety, and accessibility. Residential construction is like an amateur tennis tournament, commercial is a Grand Slam.

(4) Exiting the deal

Residential

You have two options, refinance and rent or sell. My phone is littered with mortgage brokers who are willing to offer me the best “thirty-year locked rate” loan, these loans are all similar and you can obtain one if you do enough digging. You can find tenants quite quickly if the home is in a desirable location and you can also manage the property yourself if your heart so desires. Selling the home is a simple transaction to a homeowner or an investor. Thirty days close with a ten-day inspection period and a one percent escrow deposit. I may be exaggerating the difficulty level, but I want to emphasize that it is simpler.

Commercial

There are a few factors that you must consider when exiting a commercial deal. Like residential, you have the choice to rent the property or to sell it. For the former, it is highly likely that you will NEED a property manager. It is difficult to self-manage commercial properties. Often there are many tenants. Managing the property is a business. The refinancing for commercial projects presents the same challenges that are at play when you are looking for construction funding. In this case, banks will want to look at the NOI2 of the property before lending on it. Overall, it is just more capital at play.

Conclusion

Overall, commercial development is more complex and more capital intensive than its residential counterpart. It is a lengthier process that poses its own difficulties in the pre-development process. That is not to say that residential development does not come with its own obstacles, but those obstacles are simpler and more foreseeable. I may come off a bit biased because my experience is in residential. When I read this again in a few years, I may have a completely different opinion. Nevertheless, at the time of writing, it is important to gain experience in real estate development under people who know what they are doing before going headfirst into commercial construction. Many people can survive one residential deal gone wrong. Few can survive a larger commercial one.

Infill lots are plots of land in a developed area. The plots are usually subdivided making it easier to obtain permits and build on them.

NOI refers to net operating income. The income generated after all operating expenses.