Week 7: Ordonez Construction Projects in 2024

Last week, we spoke about the opportunities in Florida real estate; this week, I want to show you how we’re capitalizing on them.

This edition is action-packed!!

This edition has the following sections:

Learning: How our homes are built

Adding Value: Ordonez Construction Projects in 2024

Florida Markets: Stats for FL markets 2023 Q3 vs Q4 (premium)

Interesting things: Tweets (premium)

Other Stuff: Soil Studies(premium)

Enjoy!

Learning:

Our Construction Process

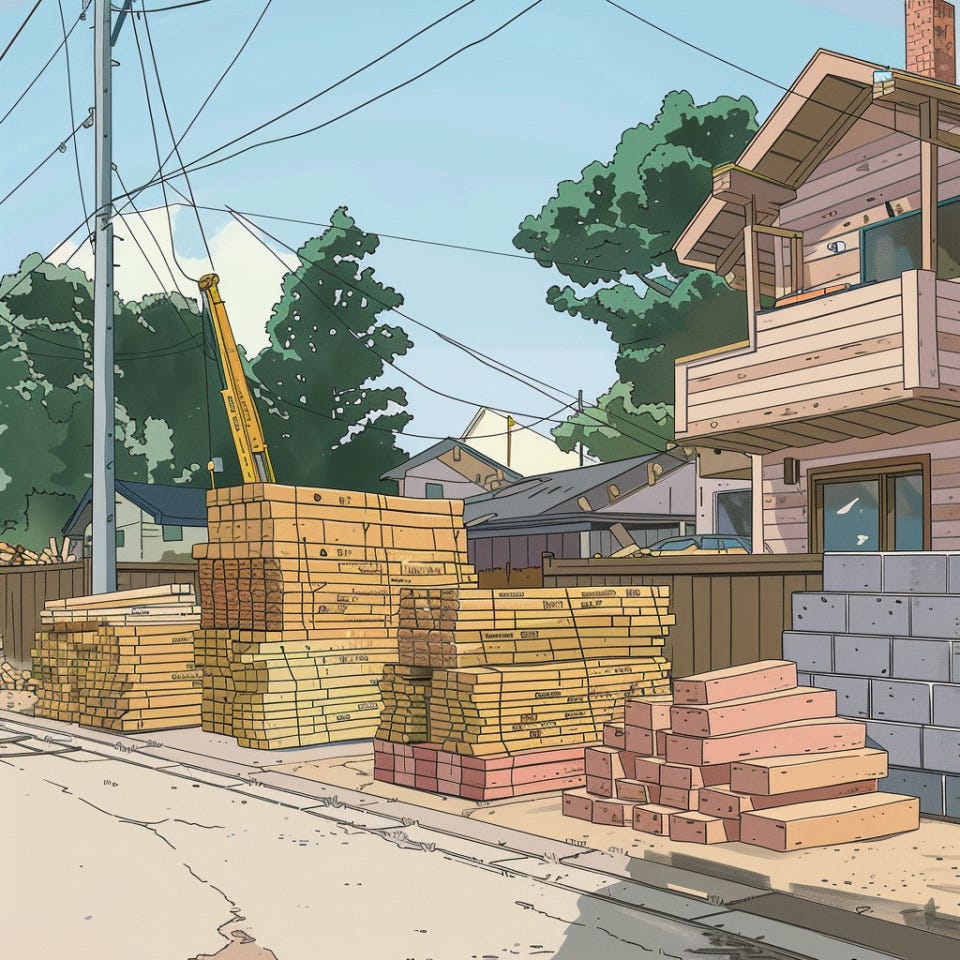

I’ve written briefly about our construction process link. Above is a video that illustrates how our homes are built. Perhaps I will write more about it in another post, but for now, we showcase the required steps:

Clearing: Clear the land and prep the site for construction

Foundation and Structure: Very literal. This is the step where we lay the base for the home via a monolithic slab and masonry blocks to make up the interior structure. It is great in Florida due to the wear and tear of heat, termites, and stormy weather (and hurricanes).

Exterior: This refers to all the details that make the home look nice and the roofing. Paint, Stucco, Driveway, Landscaping, Septic(If Applicable) all contribute to the exterior

Interior: The interior consists of the living spaces, the walls, the cabinets, hardware, appliances, flooring, etc.

Residential Underwriting Course: How to Find and Analyze Deal

There are still spots left for the class I’m teaching on Sunday, March 3rd. Make sure to sign up if you haven’t already. It comes with one year of access to our Acristo Engine underwriting software.

Adding Value: Ordonez Construction Projects in 2024 TL;DR

(For those who don’t want to read, here is the TL;DR (powered by ChatGPT):

In the past five years, we've been on a mission with our partners to revolutionize affordable housing across Florida, leveraging our unique 5-step system. This approach, encompassing everything from land acquisition to project completion, consistently generates over $20,000 net profit per home and about 12% in rental returns. Here's a snapshot of how we do it:

Finding: We're hands-on in scouting undervalued land, backed by strategic market insights.

Designing: Whether adapting existing plans or crafting new ones, our designs meet both aesthetic and practical needs.

Permitting: Our expertise streamlines the permitting process, ensuring each project advances without a hitch.

Funding: We invest upfront in every project, securing additional funds through loans and investor capital, demonstrating our commitment and confidence.

Building: Our construction phases, managed by our seasoned team and trusted subcontractors, bring our visions to reality.

Exiting: Our strategic exits, through sales or rentals, maximize returns for all involved.

Investing

We offer a variety of partnership opportunities tailored to meet different investment objectives:

Debt Partnership: Secure, preferred returns (8-12%) on short-term projects.

Equity Partnership: Share the project profits for potentially higher gains.

New Fund: Access larger, diversified deals through our pooled investment fund.

Client Partnership: Directly fund a project and own the final property, with our full support if needed.

Full Read: Ordonez Construction Projects in 2024

Last week, I highlighted the development opportunities in Florida and our optimism for the region. For the previous 5 years, we have partnered with investors to create beautiful, affordable housing across the state. We use a 5-step construction system—finding, designing, permitting, building, and exiting—to consistently drive profits. On average, we net over $20,000 per home sold and have rental returns of around 12%. In this section, I want to delve deeper into our proven process and how it can strengthen your investment strategy.

Our Process

Finding:

Our dedicated 4-person disposition team is constantly looking for undervalued land.

The managing partners (us) create an investment strategy guided by the demographics, market demands, and economic drivers within Florida. Our goal is to be where the growth is.

We identify the optimal submarkets for our projects, ensuring each site aligns with our vision.

Leveraging this groundwork, our dispositions team compiles targeted lists of potential acquisitions, incorporating on-market and off-market opportunities.

After negotiation and due diligence, we secure the land that forms the foundation of our projects.

Designing:

When designing the project, we either adapt one of our existing, proven designs or create new ones tailored to the project's unique requirements.

Our managing team works closely with our engineers and architects to produce designs that meet the building department's requirements and aesthetically align with our style.

For our staple build-to-rent homes and duplexes, we have six designs already approved for all the markets we build. These are much easier to get permitted, and we may only have to make minor adjustments as the county calls for it.

The design process is more intricate for one-off projects, like apartment complexes, commercial buildings, or custom homes, requiring more work to meet regulatory standards and community needs.

Permitting:

Together with our designers, we prepare and submit the designs above as permit packages to the county, tailored to the specifics of each project.

Our standard homes and duplexes follow a more direct permitting path; there are few revisions, and it is more of a rinse-and-repeat process.

We typically need the following documents to be approved:

Survey

Plot Plan

Architectural Plans

Energy Calculations

It is often more time-consuming for the other designs and larger projects as the designers, engineers, permitting team, and building department have to work hand in hand to make the project work.

For example, with commercial buildings, there will be a two-step process for the permit:

The civil permit: Site work, stormwater, landscaping, traffic, etc

The building permit: Construction plans

These projects are more complex, so it often takes over a year to approve the permit.

Funding the Vision:

Developing these projects isn't free. It takes a lot of capital. After a lot of trial and error, we have come up with a process that works well for us, allowing us to scale and provide significant returns for investors:

As we get close to permit approval, our focus shifts to securing the necessary funding. We have a real estate division that works with lenders to ensure the construction loans while the managing partners work on raising money from investors.

We like to "eat our cooking," so we put up the initial funding for the land and design/permitting costs. This ensures we have control over what projects we start and shows investors that we have skin in the game and have faith in our projects. We then use construction loans and private investor capital to fund the rest of the project.

Bringing Designs to Life:

With permits in hand and funding secured, construction commences.

We subcontract all masonry, framing, and MEPs (Mechanical, electrical, Plumbing) to trusted local subcontractors with solid relationships. The rest of the work is handled by our in-house team of over 20 superintendents, project managers, and laborers who perform the rest of the construction activities.

We split the construction into 5 phases

Phase 1: Site Clearing - Form

Phase 2: Form - Masonry Blocks (Structure)

Phase 3: Masonry Blocks - Drywall

Phase 4: Drywall - Interior Details

Phase 5: Interior Details - Certificate of Occupancy

Realizing Returns:

When the project arrives at Phase 4, we evaluate the market, strategizing whether to sell or rent; we want to exercise the options to maximize returns for our partners and ourselves.

Investment Thesis:

Our investment thesis is to find growing markets in Florida with an inventory shortage. We like to identify where people are moving to and what jobs are available or are coming to the area. We want submarkets where a large corporation is present or is moving to the area (think a giant Amazon warehouse or a new hospital)

Some of the markets we are building include:

Marion County

Charlotte County

Volusia County

Polk County

We have 2 main goals at our company

Provide beautiful, affordable housing

Provide our investors with consistently great returns so they can build generational wealth.

Building these projects at way below market value allows us to have consistently great returns for our investors while making a great product at an affordable price.

Due to our in-house operations and experience, we can lower our costs and provide genuinely affordable housing. This starts with the land, the construction, and the materials:

Land

As stated, an experienced dispositions team is looking for land at deep discounts. We look at thousands of land parcels yearly without paying top dollar for any piece of land.

Construction

We currently have a construction crew at all our job zones that handles most of the construction, so we don't have to subcontract everything. This lowers our labor costs by a lot. The subcontracted work is performed by long-standing relationships we have built with subcontractors who work for us in volume, giving us great prices.

Materials

We have long-standing relationships with reputable vendors, whom we buy in volume, giving us great prices, especially with concrete, lumber, and roofing materials, which are the most expensive. Another thing we have started doing is getting our material at deep discounts from Chinese vendors, which allows us to get our materials in bulk and discount up to 20% on materials that are better quality for the same price you would get today.

As far as our investors go, Here are some of our stats:

Return Range: 8 - 12%

This is how much our investors usually make on their money per year

Average Turn around time: 8.2 months

This is how long it usually takes us to return an investor money from their initial investment.

Reinvestment Rate: 90%

The percentage of investors who reinvest their money in us

Principal Loss: 0

This is how much money we've lost investors since we launched our construction program.

Opportunities

We offer several opportunities to invest at our firm. These include

Debt Partnership: A 1-2-year project funding contract, with investors providing the capital. We build the project and return their capital plus interest, from 8-12% preferred returns depending on the investment size. This is our most popular partnership where investors can get the safest return.

Equity Partnership: Contract where the investor funds a project and can profit from the project as a whole at a specified percentage. The percentage varies per deal. This partnership is riskier because we share risk in construction, but the returns can be higher.

Fund (New): We are in the process of setting up a fund. It works similarly to the equity partnership, but we can pool together different projects and investors, allowing us to do bigger deals and earn higher returns.

Client Partnership: The investor funds the complete construction, and we build the home using our infrastructure and system. The investor keeps the property at the end and can do whatever he/she pleases. We can also provide sales and property management services. This has been a popular option for many investors since they want to own cash-flowing real estate. The hurdle for this one is that you will need more capital than the other options.

We are still looking for investors for our projects. Please complete the form below to apply for our investment opportunities.

Florida Markets

As a premium subscriber, I want to start filling you in on what’s happening within real estate markets in this edition; I want to explore the Florida market.

Keep reading with a 7-day free trial

Subscribe to Adan’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.